philadelphia wage tax calculator

The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their. Single filers pay an.

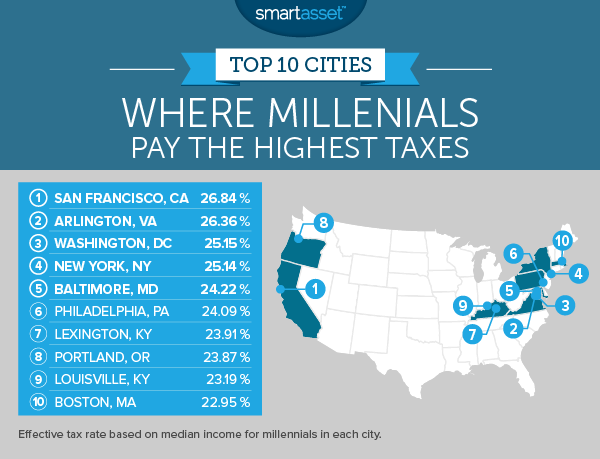

Where Millennials Pay The Highest Taxes In 2016 Smartasset

In Alabama the sales tax rate is 4 the sales tax rates in cities may differ to upto 5.

. Calculate your Pennsylvania net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Pennsylvania paycheck calculator. You must withhold 38712 of earnings for employees who live in Philadelphia. The Philadelphia City Wage Tax is a tax on earnings applied to payments that an individual receives from an employer for work or services.

The new BIRT income tax rate becomes effective for tax year 2023 for returns due and taxes owed in 2024. The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Pennsylvania Income Tax Calculator 2021.

The City of Philadelphia is a city built by entrepreneurs. Enter your info to see your take home pay. The social security tax rate is 62 and the Medicare tax is 145 of gross income.

Were building something new. Philadelphia Wage Tax Calculator. The median household income is.

Residents of philadelphia pay a flat city income tax of 393 on earned income in addition to the. SmartAssets Pennsylvania paycheck calculator shows your hourly and salary income after federal state and local taxes. The extra 09 tax for higher wage earners is called additional medicare tax super original we know.

Everyone who lives in philadelphia is subject to the city wage tax. For example Philadelphia charges a local wage tax on both residents and non-residents. Non-residents who work in Philadelphia must also pay the Wage Tax.

Switch to Pennsylvania hourly calculator. Effective July 1 2021 the rate for residents is 38398. Wage and Earnings taxes Starting on July 1 the new resident rate for.

Our Citys success is based on. Constitution and the Gettysburg Address were written. The Sales tax rates may differ depending on the type of purchase.

See where that hard-earned money goes - Federal Income Tax Social Security and. Your average tax rate is 1198 and your. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Pennsylvania.

If you make 70000 a year living in the region of Pennsylvania USA you will be taxed 10536. Medicare Tax is 145 of each employees taxable wages until they have earned 200000 in a given calendar year. Method to calculate Philadelphia sales tax in 2022.

Its largest city is Philadelphia and is also where Declaration of Independence US. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Once that earning amount surpasses 200000 the rate is.

All Philadelphia residents owe the City Wage Tax regardless of where they work. Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the. Tax rate for nonresidents who work in Philadelphia.

How to use bir tax calculator 2022. The maximum taxable earnings for social security tax is 142800 for the year 2021. For questions about City tax refunds you can contact the Department of Revenue by emailing the Tax Refund Unit or calling any of the following phone numbers.

Why Gusto Payroll and more Payroll. Business Services Automobile and Parking Wage Tax. Living Wage Calculation for Philadelphia County Pennsylvania.

Free Weekly Payroll Tax Worksheet Payroll Taxes Payroll Checks Payroll Template

North Carolina Providing Broad Based Tax Relief Grant Thornton

Pin By Om Sarthi Solutions On Logo Investing The Unit Income Tax

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

Philadelphia Budget Update Decrease In The Business Income And Receipts Tax Birt Alloy Silverstein

Pennsylvania Paycheck Calculator Smartasset

Why Households Need 300 000 To Live A Middle Class Lifestyle

Hourly Wage Then Log Download Pay Stub Template Word Free With Regard To Pay Stub Template Word Document Cumed O Word Free Templates Microsoft Word Templates

![]()

Pennsylvania Paycheck Calculator 2022 With Income Tax Brackets Investomatica

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How To Calculate Federal Income Taxes Social Security Medicare Included Youtube

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Pennsylvania Rules On Philly Wage Tax Credit Case Grant Thornton

Philly Announces New Tax Rates For Wage Earnings And Other Taxes Department Of Revenue City Of Philadelphia

W 2 Form For Wages And Salaries For A Tax Year By Jan 31

Income Tax Hike Looming For Ny Empire Center For Public Policy

Pennsylvania Reduces Corporate Income Tax Rate Grant Thornton

Payroll Tax Suspension To Start In September Will Increase Employee Take Home Pay 6abc Philadelphia Payroll Taxes Accounting Jobs Payroll